Appearance

Netra's Methodology

Netra goes beyond basic data aggregation to provide deep, actionable intelligence. Our methodology is designed to uncover hidden risks and extract maximum value from your entity data, transforming your approach to risk management.

Uncovering Hidden Risks: The Netra Advantage

Traditional due diligence often relies on known datasets, leaving critical blind spots. Netra's advanced enrichment capabilities demonstrate a unique ability to:

- Enrich existing entity data with open-source intelligence: We leverage a vast array of publicly available information, going beyond what's typically found in standard commercial databases.

- Identify significant risks: Our sophisticated engine cross-references data points to identify sanctions, Politically Exposed Persons (PEPs), and adverse media mentions that may not be present in your current datasets.

- Reveal hidden risks you're unaware of: This is Netra's core differentiator. We bring to light connections and exposures that are often overlooked, providing a comprehensive risk profile.

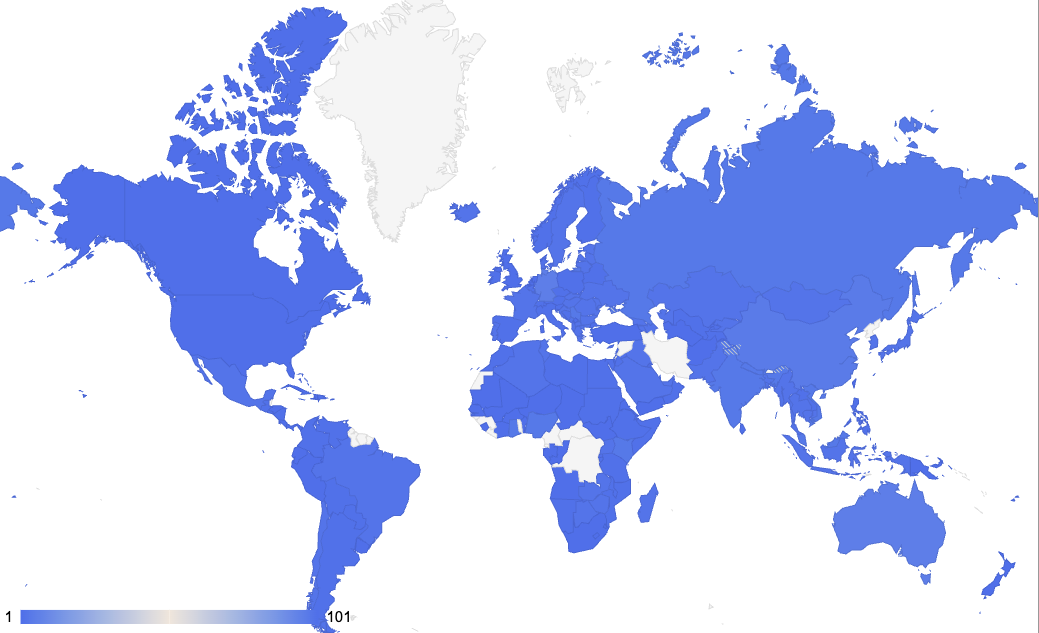

Data Sources & Global Coverage

Netra aggregates and analyzes data from a diverse range of open-source and proprietary sources across 190+ countries, enabling robust and dynamic risk profiling.

Data Categories

We collect and synthesize intelligence from the following categories:

- Global Sanctions Lists: OFAC, UN, EU, HM Treasury (UK), and other jurisdictional sources.

- Politically Exposed Persons (PEP) Databases: Aggregated lists of individuals holding prominent public functions.

- Adverse Media Monitoring: Continuous scanning of reputable news sources, online publications, and public records for negative mentions.

- Company Registries: Official government and commercial databases offering incorporation data, beneficial ownership, and director profiles.

- Legal & Regulatory Filings: Court records, enforcement notices, and regulatory disclosures.

- Public Financial Data: Financial indicators and filings (where available) to support transparency and screening.

Source Confidence & Customization

Netra's platform tags each data point with a confidence level, empowering users to filter by trust and compliance needs. You can choose to rely on, prioritize, or exclude data from the following source types:

| Source Type | Description |

|---|---|

| Official Registries | Government-backed databases (e.g., SEC, Companies House, BvD, EBRA) |

| Third-Party Providers | Commercial AML/KYC vendors and investigative data suppliers |

| International Orgs | Sanctions bodies, FATF, UN, World Bank |

| Global Registries | Aggregators like OpenCorporates, ICIJ (Offshore Leaks) |

| News & Media | Reputable press sources and open media crawlers (e.g., Reuters, OCCRP) |

Risk Assessment Framework

Netra employs a multi-faceted risk assessment framework that combines qualitative and quantitative analysis:

- Data Ingestion & Normalization: Raw data from various sources is ingested, cleaned, and standardized.

- Entity Resolution & Link Analysis: Advanced algorithms link disparate data points to form a comprehensive network graph of individuals and organizations.

- Risk Factor Identification: Our system identifies specific risk indicators (e.g., sanction hits, PEP status, adverse media events) and their severity.

- Contextual Scoring: Risk factors are weighted based on their relevance and impact, considering the entity's type, country, and industry.

- Dynamic Risk Profiling: Risk scores are continuously updated as new information becomes available, providing a real-time risk posture.

Entity Risk Score Engine

Netra's Risk Score Engine evaluates the financial crime and compliance risk of an entity using a weighted, rules-based model. The methodology combines structured data (e.g., registries, sanctions lists) and unstructured intelligence (e.g., adverse media) to assess exposure across multiple categories. Each risk factor is assigned a specific weight based on regulatory relevance and empirical impact. The engine calculates a total score from 0 to 100, classifying the entity into low, medium, or high risk tiers. The score is broken down into components for transparency and traceability, enabling compliance teams to understand and justify decisions. All data is sourced from reputable global lists, risk databases, and open registries, and scores are dynamically updated as new information becomes available. This systematic approach supports consistent, auditable, and scalable risk assessments aligned with AML and KYC best practices.

| Risk Factor | Weight (%) |

|---|---|

| Sanctions | 18% |

| PEP Involvement | 11% |

| Ownership Transparency & Structure | 10% |

| Nationality of Owners | 7% |

| Sector / Industry Risk | 16% |

| Geographical Risk | 16% |

| Adverse Media | 12% |

| Data Quality | 10% |

Strategic Impact for Your Organization

Integrating Netra's API transforms your risk and compliance capabilities from a necessary overhead into a strategic advantage:

- Enhanced Due Diligence: Go deeper and faster with automated, comprehensive risk screening.

- Proactive Risk Mitigation: Identify emerging threats before they escalate, protecting your reputation and financial stability.

- Operational Efficiency: Automate manual data gathering and analysis, freeing up your team to focus on critical decision-making.

- Unlocking Entity Value: By enriching your existing data, Netra helps you unlock hidden insights and derive more strategic value from your vast entity footprint.

Netra's API enables you to move beyond basic compliance, allowing you to confidently navigate complex global landscapes and make informed strategic decisions.

Full Source Coverage & Registry Mapping

For a complete list of data sources, jurisdictions, and source types, see: 🔗 Netra Data Sources Spreadsheet This includes:

- Registry coverage by country

- Confidence levels

- Source classifications

- Language availability and refresh cadence